FAU DC Chapter

For Immediate Release

February 28, 2017

Presidential Executive Order on The White House Initiative to Promote Excellence and Innovation at Historically Black Colleges and Universities

EXECUTIVE ORDER

WHITE HOUSE INITIATIVE TO PROMOTE EXCELLENCE AND INNOVATION AT HISTORICALLY BLACK COLLEGES AND UNIVERSITIES

By the authority vested in me as President by the Constitution and the laws of the United States of America, and in order to advance opportunities in higher education, it is hereby ordered as follows:

Section 1. Policy. Historically black colleges and universities (HBCUs) have made, and continue to make, extraordinary contributions to the general welfare and prosperity of our country. Established by visionary leaders, America’s HBCUs have, for more than 150 years, produced many of our Nation’s leaders in business, government, academia, and the military, and have helped create a black middle class. The Nation’s more than 100 HBCUs are located in 20 States, the District of Columbia, and the U.S. Virgin Islands, and serve more than 300,000 undergraduate, graduate, and professional students. These institutions are important engines of economic growth and public service, and they are proven ladders of intergenerational advancement.

A White House Initiative on HBCUs would: advance America’s full human potential; foster more and better opportunities in higher education; strengthen the capacity of HBCUs to provide the highest-quality education; provide equitable opportunities for HBCUs to participate in Federal programs; and increase the number of college-educated Americans who feel empowered and able to advance the common good at home and abroad.

Sec. 2. White House Initiative on HBCUs.

(a) Establishment. There is established the White House Initiative on Historically Black Colleges and Universities (Initiative), housed in the Executive Office of the President and led by an Executive Director designated by the President.

(b) Mission and Functions. The Initiative shall work with agencies, private-sector employers, educational associations, philanthropic organizations, and other partners to increase the capacity of HBCUs to provide the highest-quality education to an increasing number of students. The Initiative shall have two primary missions:

(i) increasing the private-sector role, including the role of private foundations, in:

(A) strengthening HBCUs through enhanced institutional planning and development, fiscal stability, and financial management; and

(B) upgrading institutional infrastructure, including the use of technology, to ensure the long-term viability of these institutions; and

(ii) enhancing HBCUs’ capabilities to serve our Nation’s young adults by:

(A) strengthening HBCUs’ ability to equitably participate in Federal programs and exploring new ways of improving the relationship between the Federal Government and HBCUs;

(B) fostering private-sector initiatives and public-private partnerships while promoting specific areas and centers of academic research and program-based excellence throughout HBCUs;

(C) improving the availability, dissemination, and quality of information concerning HBCUs in the public policy sphere;

(D) sharing administrative and programmatic best practices within the HBCU community;

(E) partnering with elementary and secondary education stakeholders to build a “cradle-to-college” pipeline; and

(F) convening an annual White House Summit on HBCUs to address, among other topics, matters related to the Initiative’s missions and functions.

(c) Federal Agency Plans.

(i) The Secretary of Education (Secretary), in consultation with the Executive Director, shall identify those agencies that regularly interact with HBCUs.

(ii) Each agency identified by the Secretary under subsection (c)(i) of this section shall prepare an annual plan (Agency Plan) describing its efforts to strengthen the capacity of HBCUs to participate in applicable Federal programs and initiatives. Where appropriate, each Agency Plan shall address, among other things, the agency’s proposed efforts to:

(A) establish how the agency intends to increase the capacity of HBCUs to compete effectively for grants, contracts, or cooperative agreements;

(B) identify Federal programs and initiatives where HBCUs are not well represented, and improve HBCUs’ participation in those programs and initiatives; and

(C) encourage public-sector, private-sector, and community involvement in improving the overall capacity of HBCUs.

(iii) The head of each agency identified in subsection (c)(i) of this section shall submit its Agency Plan to the Secretary and the Executive Director no later than 90 days after being so identified, and submit an updated Agency Plan annually thereafter.

(iv) To help fulfill the objectives of the Agency Plans, the head of each agency identified by the Secretary may provide, as appropriate, technical assistance and information to the Executive Director to enhance communication with HBCUs concerning the agency’s program activities and the preparation of applications or proposals for grants, contracts, or cooperative agreements.

(v) Each agency identified by the Secretary shall appoint a senior official to report directly to the agency head on that agency’s progress under this order, and to serve as liaison to the Initiative.

(d) Interagency Working Group. There is established an Interagency Working Group, which shall be chaired by the Executive Director and shall consist of one representative from each agency identified by the Secretary pursuant to subsection (c)(i) of this section, to help advance and coordinate the work required by this order.

Sec. 3. President’s Board of Advisors on HBCUs.

(a) Establishment. There is established in the Department of Education the President’s Board of Advisors on Historically Black Colleges and Universities (Board). The Board shall consist of not more than 25 members appointed by the President. The Board shall include the Secretary, the Executive Director, representatives of a variety of sectors — such as philanthropy, education, business, finance, entrepreneurship, innovation, and private foundations — and sitting HBCU presidents. The President shall designate one member of the Board to serve as its Chair, who shall help direct the Board’s work in coordination with the Secretary and in consultation with the Executive Director. The Chair shall also consult with the Executive Director regarding the time and location of the Board’s meetings, which shall take place at least once every 6 months.

(b) Mission and Functions. The Board shall advise the President, through the Initiative, on all matters pertaining to strengthening the educational capacity of HBCUs. In particular, the Board shall advise the President in the following areas:

(i) improving the identity, visibility, distinctive capabilities, and overall competitiveness of HBCUs;

(ii) engaging the philanthropic, business, government, military, homeland-security, and education communities in a national dialogue regarding new HBCU programs and initiatives;

(iii) improving the ability of HBCUs to remain fiscally secure institutions that can assist the Nation in achieving its educational goals and in advancing the interests of all Americans;

(iv) elevating the public awareness of, and fostering appreciation of, HBCUs; and

(v) encouraging public-private investments in HBCUs.

(c) Administration. The Department of Education shall provide funding and administrative support for the Board, consistent with applicable law and subject to the availability of appropriations. Members of the Board shall serve without compensation, but shall be reimbursed for travel expenses, including per diem in lieu of subsistence, as authorized by law. Insofar as the Federal Advisory Committee Act, as amended (5 U.S.C. App.), may apply to the Board, any functions of the President under that Act, except for those of reporting to the Congress, shall be performed by the Chair, in accordance with guidelines issued by the Administrator of General Services.

(d) Report. The Board shall report annually to the President on the Board’s progress in carrying out its duties under this section.

Sec. 4. Revocation of Executive Order. Executive Order 13532 of February 26, 2010 (Promoting Excellence, Innovation, and Sustainability at Historically Black Colleges and Universities), as amended, is revoked.

Sec. 5. General Provisions. (a) For the purposes of this order, “historically black colleges and universities” shall mean those institutions listed in 34 C.F.R. 608.2.

(b) This order shall apply to executive departments and agencies designated by the Secretary. Those departments and agencies shall provide timely reports and such information as is required to effectively carry out the objectives of this order.

(c) The heads of executive departments and agencies shall assist and provide information to the Board, consistent with applicable law, as may be necessary to carry out the functions of the Board. Each executive department and agency shall bear its own expenses of participating in the Initiative.

(d) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(e) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(f) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

DONALD J. TRUMP

THE WHITE HOUSE,

February 28, 2017.

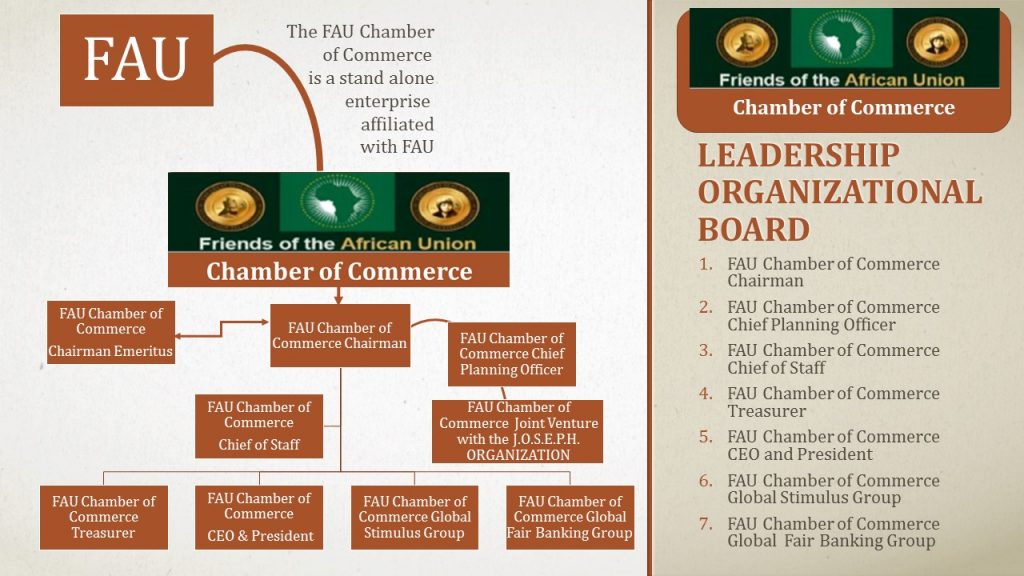

The FAU Plan calls for a $9B plan for DC.

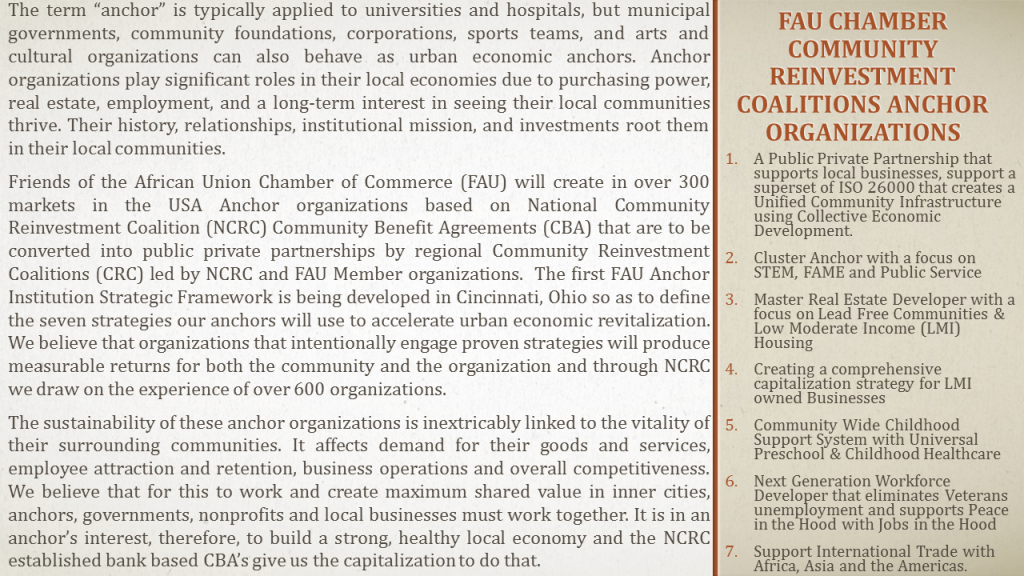

| Public Private Partnership between the private sector driven by FAU Chamber of Commerce member businesses and their mentors and The District of Columbia Water and Sewer Authority (DC Water) which provides drinking water, sewage collection and sewage treatment in Washington, D.C.. The utility also provides wholesale wastewater treatment services to several adjoining municipalities in Maryland and Virginia, and maintains more than 9,000 public fire hydrants in the District of Columbia. DC Water was created in 1996, when the District Government and the U.S. federal government established it as an independent authority of the District government.. The funds will be reinvested in real estate and projects that employ residents of the DC to remove lead and that will return funds that will be used to keep rates down to what they are now. In 2010, the CDC said that 15,000 homes in the DC area might still have water supplies with dangerous levels of lead

This program will create a billion dollar construction contract for African American Businesses and their partners who are aligned with FAU Chamber Core Company Environmental Alliance. |

$3B |

| Housing Program We will create a housing program to create a lead-free county housing stock by 2030. In addition, we will be the first homeless population county in the state of Ohio based on everyone deserves a home program as part of the FAU New American Rites of Passage Housing Program. | |

| FAU New American Rites of Passage Housing Program Public Housing Recapitalization will provide for residents of DC public housing the building of new homes in mixed-use developments in the core city. | $500M |

| FAU New American Rites of Passage Housing Program Everyone Deserves a Home will start with DC Veterans, then people with Disabilities, then Seniors, then new Adults till everyone in the county has a home and there is no one without. | $500M |

| In our FAU New American Rites of Passage Housing Program Low-Moderate Income Housing program. we will concentrate on offering homes to our teacher’s aides in our schools, child care professionals, home health care professionals, and low-income public service workers including those who have volunteered to serve in the DC National Guard or U.S Military as a special focus. | $500M |

| Market Rate Housing This is part of our program to bring safety back in the neighborhoods by offering the police, deputy sheriffs, bailiffs and others in the Justice System as well as other government employees for below market rate loans to build a home in the city. We would offer funds to all government employees to build a new home in the city and or the county, notwithstanding their credit score. | $500M |

| Business Create a fund for 1,000 African American Businesses who are aligned with FAU Chamber Core Company Alliances in – (1) General Construction and Real Estate Development (2) A/E/C Professional Services (3) Facilities Management & Construction Trades (4) International Trade (5) STEM (6) The Internet (7) Computing and Communications (8) Fashion, Arts, Music and Entertainment (9) Food Service, Restaurants, Food & Beverages (10) Agriculture and Groceries (11) Organic and Healthy Products (12) Education (13) Financial Services, Accounting & Economic Development (14) Professional Services including management consultants, legal and accounting (15) Medical and Health Services (16) Automotive, Transportation and Logistics (17) Retailing including online (18) Clothing Design, Manufacturing and Retailing (19) Manufacturing, Production & Wholesale (20) Sports and Recreation (21) Hospitality and support established businesses in these areas with other targeted business communities including Veterans, Victims of Crime, Minorities, Appalachians, Women, People with Disabilities, Low-Income Residents of County, at Risk Youth, Addiction Reentry, out of work Seniors and Re-entry from a life of Crime – convicted or not. | $2B |

| Intermodal Transportation will include money to upgrade the city bus fleet when combined with the School Bus System for the best bus service for our families in the national capital with funds for the Washington Metropolitan Area Transit Authority. | $1B |

| Community Development This program will work in partnership with an established statewide Community Housing Development Organization (CHDO). A CHDO is a private nonprofit, community-based organization that has staff with the capacity to develop affordable housing for the community it serves. In Hamilton county, we will use our funds to develop to leverage the development of 20,000 HH by 2020 in DC. We will also use funds to make the city lead free. | $1B |

Among the tools we will use –

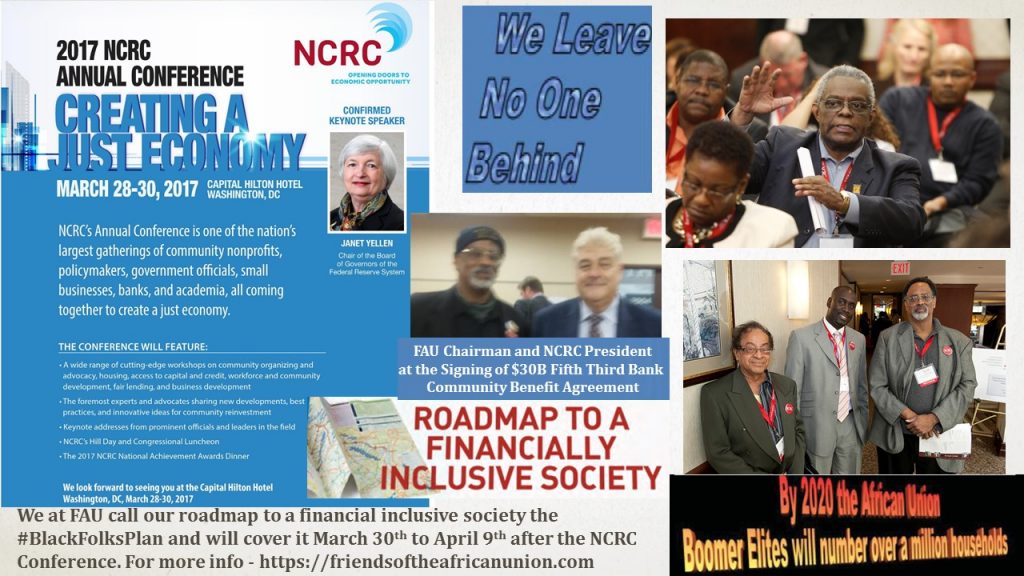

FAU’s road-map to a financial secure African American Society is based on the $5T dollar solution which addresses the damage incurred by past and current federal gov racism against African Americans

Among the Community Benefit Agreements we will use –

Fifth Third Bancorp and National Community Reinvestment Coalition and its members like Friends of the African Union Chamber of Commerce Announce Landmark $30 Billion Community Development Plan

Announce Landmark $30 Billion Community Development Plan

11/18/16

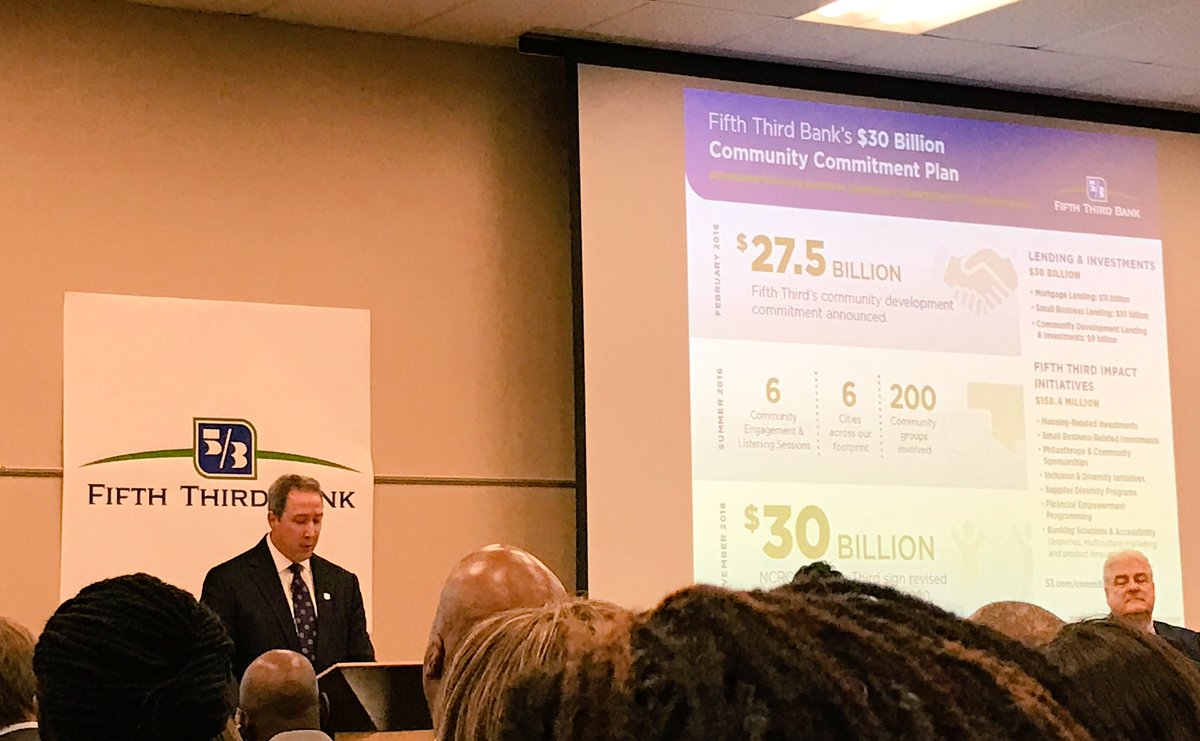

Cincinnati – Today, Fifth Third Bancorp and the National Community Reinvestment Coalition (NCRC) signed a landmark $30 billion community development plan through 2020. The plan builds on the $27.5 billion community commitment that Fifth Third announced in February 2016, and is the largest by a single bank in recent history.

The plan covers the 10 states in which Fifth Third has branches and follows weeks of discussions and six meetings between Fifth Third and community groups working with NCRC in Chicago, Charlotte, Cincinnati, Cleveland, Tampa Bay, and Washington, D.C. All told, Fifth Third met with more than 200 community-based organizations.

The plan calls for Fifth Third to invest $30 billion in its communities over a five year period, which began January 1, 2016. Lending and investments of $30 billion covered under this agreement include the following categories: mortgage lending, small business lending, including micro-lending; and community development lending and investing. The agreement also covers $158.4 million in community initiatives, including financial services, branch openings, marketing and research, product development and cooperative public policy advocacy for low- and moderate-income (LMI) communities.

“This substantive and detailed community development plan was the result of a collaborative process with community members and bank leaders,” said NCRC President & CEO John Taylor. “We applaud President & CEO Greg Carmichael and the senior leadership of Fifth Third, who after putting out a significant community commitment earlier in the year, was willing and eager to deeply engage NCRC and its member organizations in significant discussions to ensure the commitments made were in areas of the greatest community need and put in place rigorous accountability for their bank and the communities they serve.”

Fifth Third Bancorp President & CEO Greg D. Carmichael, said, “Fifth Third is deeply committed to both investing significant resources into the community as well as engaging community members and leaders. Our objective is to ensure that, together with the NCRC, we meaningfully impact the communities we serve. We appreciate and value the collaboration with John Taylor and all the NCRC member organizations who met with us to enable the expansion of our original commitment in ways that will best improve lives.”

“Fifth Third and NCRC’s investment in Ohio will create opportunities for businesses and families to seek the resources they need to make their communities stronger,” said U.S. Senator Sherrod Brown. “I applaud these organizations for working with people across the state, and I’m glad their investment will provide meaningful help to Ohioans.”

A summary of the community development plan follows:

Fifth Third increased its overall goal for mortgage lending to LMI borrowers and census tracts, and added a home purchase sub-goal. The commitment includes product innovation to address community needs, and includes a Second Look Program, down payment assistance, support for housing counseling, and other activities, including affirmative marketing and outreach, evaluation and improvement of its Fair Housing/Lending program, and the continuation of its current policy of not imposing minimum loan amounts.

SMALL BUSINESS LENDING: $10 BILLION

Fifth Third is committed to improving its lending to small businesses with gross annual revenue below a million in all markets and communities. The commitment includes increased support for small businesses, product innovation, and enhanced underwriting and fulfillment.

COMMUNITY REINVESTMENT ACT (CRA) COMMUNITY DEVELOPMENT LENDING: $9 BILLION

Fifth Third will strive to achieve peer-leading performance in the amount of combined community development loans and investments (CDLI) over the course of the five-year commitment. Increases in CDLI activities will be supported by initiatives in affordable housing, a revolving loan fund, community development corporations, community development financial institutions, community pre-development resources, housing rehab loan pools and land banks. The Fifth Third Community Development Corporation will also make $1 billion in tax credit investments.

Fifth Third will make housing-related investments that address the gap for consumers who need down payment assistance to achieve homeownership, support housing counseling and financial literacy to help families and individuals achieve their long-term financial goals, and help fund housing loan pools for minor home repairs or gap financing to support neighborhood revitalization. Fifth Third Bank will also make small business-related investments that provide technical assistance for small business development and growth, and support the ecosystem for small business lending. The Bank will strengthen communities through significant philanthropic grants and donations and impactful community sponsorships. Charitable giving will include a focus on providing organizations with resources for capacity building, workforce training, and assistance for older adults.

The Fifth Third Impact programming includes branch and staff commitments. Fifth Third will seek to open at least 10 more branches in LMI and/or high minority communities. Fifth Third will establish the position of Senior CRA Mortgage Lender, and continue to retain and hire mortgage loan originators focused on CRA success. It will expand small business staffing with a newly-created role for CRA Small Business lenders.

Fifth Third’s Inclusion and Diversity plan supports the Bank’s commitment to ensure that its human capital is inclusive and diverse. The Bank will increase its efforts to support diverse suppliers, minority-owned, women-owned and veteran-owned businesses.

Fifth Third Impact programming also includes the delivery of Fifth Third’s L.I.F.E. (Lives Improved through Financial Empowerment®) programs, which strive to reach consumers at every age and stage of life through foundational financial education. These programs include, but are not limited to programs for children and teens, including the Fifth Third Bank Young Bankers Club®, and programs for adults like Fifth Third Bank Empower U® adult financial education courses. Fifth Third’s L.I.F.E. programs also include the Company’s Financial Empowerment Mobiles, or eBuses, which deliver financial education, job training, tax preparation and other assistance directly to low- and moderate-income communities on their own and in partnership with local community organizations.

“As a member of the Dayton community, I am pleased to see that Fifth Third has made a commitment to ensuring financial services to low- and moderate-income communities and individuals as well as small businesses,” said Catherine Crosby, executive director, City of Dayton Human Relations Council and NCRC Board member. “Small businesses are the primary employers in Dayton, which makes it critical to ensure that resources are available not only for financial stability, but also to build capacity through technical assistance. We look forward to continuing our partnership to fulfill mutual goals for economical sustainability in diverse low- and moderate-income communities in Dayton.”

“NHS of Greater Cleveland welcomes the opportunity to continue our partnership with Fifth Third Bank to implement this broad-reaching plan that will positively affect the residents and the communities we serve in northeast Ohio,” said Lou Tisler, executive director, Neighborhood Housing Services of Greater Cleveland.

“I am delighted that Fifth Third approached NCRC and its Illinois members to jointly create a strong CRA plan based on community needs and input,” said Dory Rand, president, Woodstock Institute. “I look forward to working with them to implement the plan and reap the benefits of increased and improved lending, investments, branches and services in underserved low- and moderate-income neighborhoods in Illinois and across the country.”

Sister Barbara Busch, executive director of Working in Neighborhoods in Cincinnati, said, “I am glad to see that Fifth Third is willing to work with communities to provide equal access to mortgages and other banking products at a competitive rate. I am looking forward to seeing changes in Fifth Third’s products and programs to achieve equity for low- and moderate-income and minority communities.”

“Fifth Third has several branches in Northwest Indiana and organizations here are excited to see increased support for our programs that benefit low- and moderate-income borrowers,” said Jean Ishmon, consulting executive director, Northwest Indiana Reinvestment Alliance. “I am encouraged by the upcoming partnership and have met with some of the new staff. Organizations are hopeful that the Bank will be more actively-involved in our quest to serve the residents of the Gary Metropolitan Statistical Area.”

Deborah Scanlan, CEO of Neighborhood Home Solutions, said, “This agreement is vital for the future communities in the Tampa Bay region—for community development investing, home mortgage lending and capacity building for nonprofit partners of the Bank.”

In addition to NCRC and Fifth Third Bank, the agreement was signed by 136 member organizations:

Charisma Community Connection, Akron, Ohio

Action NC, Durham and Charlotte, North Carolina

Affordable Homeownership Foundation, Inc., Fort Myers, Florida

Another Chance of Ohio, Cleveland, Ohio

Antioch Baptist Church, Akron, Ohio

Aurora, Evansville, Indiana

Baptist Minister’s Conference of Cincinnati and Vicinity, Cincinnati, Ohio

Birmingham Development Corp., Toledo, Ohio

Breaking Chains Inc., Beachwood, Ohio

Bridging Communities, Inc., Detroit, Michigan

Bright Community Trust, Inc., Clearwater, Florida

Buckeye Shaker Square CDC, Cleveland, Ohio

Can I Live, CDC, Raleigh, North Carolina

CAPE, Evansville, Indian

Central Florida Urban League, Orlando, Florida

Central Ohio Fair Housing Association, Inc., Columbus, Ohio

Chicago Community Loan Fund, Chicago, Illinois

Chicago Rehab Network, Chicago, Illinois

Cincinnati NAACP, Cincinnati, Ohio

Cincinnati-Hamilton County Community Action Agency, Cincinnati, Ohio

City of Dayton Human Relations Council, Dayton, Ohio

City of Euclid, Ohio

City of South Euclid, Ohio

CityWide Development Corporation, Dayton, Ohio

Clearwater Neighborhood Housing Services, Incorporated, Clearwater, Florida

Cleveland Realtist Association, Cleveland, Ohio

Collective Empowerment Group of Cincinnati, Cincinnati, Ohio

Collective Empowerment Group Tampa Bay Area (CEGTBA), St. Petersburg, Florida

Community Action Agency, Cincinnati, Ohio

Community Legal Aid Services, Inc., Akron, Ohio

Community Legal Services of Mid-Florida, Florida

Community Link, Charlotte, North Carolina

Community Matters, Cincinnati, Ohio

Community Reinvestment Alliance of South Florida, Miami, Florida

Community Service Council of Northern Will County, Bolingbrook, Illinois

Community United for Action, Cincinnati, Ohio

Comprehensive Valuation Services LLC, Florence, Kentucky

County Corp., Dayton, Ohio

Cudell Improvement, Inc., Cleveland, Ohio

Dayton Area Chamber of Commerce, Dayton, Ohio

Detroit Shoreway Community Development Organization, Cleveland, Ohio

ECHO Housing Corporation, Evansville, Indiana

ESOP, Cleveland, Ohio

F7, Raleigh, North Carolina

Fair Housing Resource Center, Inc., Painesville, Ohio

Famicos Foundation, Cleveland, Ohio

Financial Justice Coalition of SE Michigan, Detroit, Michigan

Florida Home Partnership, Inc., Ruskin, Florida

Friends of the African Union Chamber of Commerce, Cincinnati, Ohio

Genesis Housing Development Corporation, Chicago, Illinois

Georgia Advancing Communities Together, Inc., Atlanta, Georgia

Georgia Micro Enterprise Network, Atlanta, Georgia

Greater Cincinnati Microenterprise Initiative, Cincinnati, Ohio

Greater Dayton Premier Management, Dayton, Ohio

Greater Linden Development Corporation, Columbus, Ohio

Habitat for Humanity of Metro Louisville, Louisville, Kentucky

Hamilton County Community Reinvestment Group, Cincinnati, Ohio

Henderson and Company, Henderson, North Carolina

Home Repair Resource Center, Cleveland Heights, Ohio

Home Ownership Center of Greater Dayton, Dayton, Ohio

Homes on the Hill CDC, Columbus, Ohio

HomesteadCS, Lafayette, Indiana

Housing Foundation of America, Pembroke Pines, Florida

Housing Opportunities Made Equal of Greater Cincinnati, Cincinnati, Ohio

Housing Research & Advocacy Center, Cleveland, Ohio

IMPACT Community Action, Columbus, Ohio

Indiana Association for Community Economic Development, Indianapolis, Indiana

Institute of Cultural Affairs – USA, Chicago, Illinois

Legal Aid Society of Southwest Ohio, LLC, Cincinnati, Ohio

LINKS Community and Family Services, Akron, Ohio

Louisville Affordable Housing Trust Fund, Louisville, Kentucky

Lucas County Land Bank, Toledo, Ohio

Madisonville Community Urban Redevelopment Corporation, Cincinnati, Ohio

Memorial Community Development Corp., Evansville, Indiana

Metropolitan Housing Coalition, Louisville, Kentucky

Miami Valley Fair Housing Center, Inc., Dayton, Ohio

Miami Valley Urban League, Dayton, Ohio

Michigan Community Reinvestment Coalition, Lansing, Michigan

Montgomery County, OH, Dayton, Ohio

Mt. Pleasant NOW Development Corporation, Cleveland, Ohio

Mustard Seed Development Center, Akron, Ohio

National Housing Counseling Agency, McDonough, Georgia

Nazareth Housing Development Corp., Akron, Ohio

NC Community Development Initiative/Initiative Capital, Raleigh, North Carolina

North Carolina Housing Coalition, Raleigh, North Carolina

Neighborhood Housing Services of Greater Cleveland, Cleveland, Ohio

Neighborhood Housing Services of South Florida, Miami, Florida

Neighborhood Lending Partners of Florida, Inc., Tampa, Florida

Neighborhood Service Organization (NSO), Detroit, Michigan

New Frontier CDC, Winston-Salem, North Carolina

New Level Community Development Corp., Nashville, Tennessee

Northeast Ohio First Suburbs Consortium, Cleveland Heights, Ohio

Northwest Indiana Reinvestment Alliance, Hammond, Indiana

NWSHC, Chicago, Illinois

Ohio CDC Association, Columbus, Ohio

Ohio Fair Lending Coalition, Cleveland, Ohio

Ohio SBDC at The Entrepreneurs Center, Dayton, Ohio

Ohio Urban Resources System, Cleveland, Ohio

One Voice for East Toledo, Toledo, Ohio

OPRHC/West Cook Homeownership Center, Forest Park, Illinois

Partners In Community Building, Inc. (PICB), Chicago, Illinois

Pathway, Inc., Toledo, Ohio

Peoplestown Revitalization Corporation, Atlanta, Georgia

Pinellas Opportunity Council, Inc., St. Petersburg, Florida

Pittsburgh Community Reinvestment Group, Pittsburgh, Pennsylvania

Price Hill Will, Cincinnati, Ohio

Prosperity Unlimited, Inc., Kannapolis, North Carolina

REBOUND, Inc., Louisville, Kentucky

Reinvestment Partners, Durham, North Carolina

REVA Development Corporation, Fort Lauderdale, Florida

River City Housing, Louisville, Kentucky

Rock Island Economic Growth, Rock Island, Illinois

Salem UMC, Toledo, Ohio

Slavic Village Development, Cleveland, Ohio

Small Business Development Center at Wright State University, Dayton, Ohio

Southwest Economic Solutions, Detroit, Michigan

St. Petersburg Neighborhood Housing Services, Inc., St. Petersburg, Florida

Tampa Bay Black Business Investment Corporation, Tampa, Florida

The Chicago Urban League, Chicago, Illinois

The Home Ownership Center of Greater Cincinnati, Cincinnati, Ohio

The Housing Partnership, Inc., Louisville, Kentucky

The Lion Foundation, Kissimmee, Florida

The Omega Community Development Corporation, Dayton, Ohio

The Resurrection Project, Chicago, Illinois

Toledo Fair Housing Center, Toledo, Ohio

U SNAP BAC Non Profit Housing Corporation, Detroit, Michigan

UMADAOP, Cincinnati, Ohio

United North Corporation, Toledo, Ohio

Universal Housing Solutions CDC, Chicago, Illinois

University Area Community Development Corp, Inc., Tampa, Florida

Village Capital Corporation, Cleveland, Ohio

Vision of Restoration, Inc., Maywood, Illinois

Wesley Community Center Dayton, Dayton, Ohio

Woodstock Institute, Chicago, Illinois

Working In Neighborhoods, Cincinnati, Ohio

Brian Lamb Named Chief Corporate Responsibility and Reputation Officer

Bank Veteran to Lead Newly Created Unit in charge of the $30B Community Benefit Agreement

10/26/16

Cincinnati – Fifth Third Bancorp (Nasdaq: FITB) announced today that Brian Lamb has been named its chief corporate responsibility and reputation officer. He will report to Teresa Tanner, chief administrative officer.

Cincinnati – Fifth Third Bancorp (Nasdaq: FITB) announced today that Brian Lamb has been named its chief corporate responsibility and reputation officer. He will report to Teresa Tanner, chief administrative officer.

Lamb most recently served as regional president for the Bank’s North Florida region, based in Tampa. In a newly created role, Lamb will be accountable for the comprehensive strategic framework of the Bank’s civic commitments and reputation management. He will oversee multiple areas, including Community Economic Development, the Bank’s Community Development Corporation (CDC), Corporate Communications, Diversity & Corporate Social Responsibility and Ethics.

Lamb joined Fifth Third in 2006 as chief financial officer of the Tampa Bay region. Before being named regional president, Lamb served as the head of Business Banking for that market.

“We are thrilled to name a leader with Brian’s experience and track record to this newly created and key position at Fifth Third,” Tanner said. “He brings a high degree of personal passion in serving and collaborating with the community. Brian is an outstanding banker who has produced stellar results for both the Bank and the community.”

Greg D. Carmichael, president and CEO of Fifth Third Bancorp, said, “I could not be more pleased to place Brian in this critical role. At a time when industry reputation and community commitment are paramount to our customers and stakeholders, Brian is not only a demonstrated civic leader, but also a model of personal integrity and tireless customer focus. He leads by example every day and has earned the respect of our leadership, our customers and our communities.”

He also noted that he would work closely during the transition with Brian Lamb, formerly North Florida regional president, who has just been named to the newly created position of chief corporate responsibility and reputation officer for Fifth Third Bancorp. Lamb will relocate to the corporate headquarters in Cincinnati.

“I am excited to serve Fifth Third in an entirely new capacity and lead a team dedicated to improving the lives of those in our community,” Lamb said. “The commitment of the Company to its civic and social responsibilities has never been higher, and I am looking forward to delivering strong and positive outcomes for all of our stakeholders.”

Lamb has been active in a wide variety of civic activities in Florida. He serves as chair of the University of South Florida and holds board positions on the Tampa Bay Partnership, Enterprise Florida, Florida Council of 100 and Florida Bankers Association. He has been recognized on numerous occasions, including recently receiving an honorary doctoral degree from Bethune-Cookman University. This year, he was named to the Tampa Bay Business Hall of Fame.

He is a graduate both of the University of South Florida, where he earned a bachelor’s degree in accounting, and the Stonier Graduate Banking School at the University of Pennsylvania.

Teresa Tanner becomes Fifth Third’s Chief Administrative Officer

09/09/2015

Cincinnati– Fifth Third Bancorp (Nasdaq: FITB) announced today that Executive Vice President Teresa Tanner, chief human resources officer, has been named chief administrative officer, effective immediately. Tanner’s responsibilities will expand beyond Human Capital to also include Facilities, Strategic Sourcing and the Enterprise Program Management Office.

Cincinnati– Fifth Third Bancorp (Nasdaq: FITB) announced today that Executive Vice President Teresa Tanner, chief human resources officer, has been named chief administrative officer, effective immediately. Tanner’s responsibilities will expand beyond Human Capital to also include Facilities, Strategic Sourcing and the Enterprise Program Management Office.

Tanner has led all functions within Fifth Third’s Human Capital division since 2010, directing a team of more than 300 Human Capital professionals in the disciplines of Organizational Development, HR Operations, Business Partners, Diversity, Employee Relations, Total Rewards (Compensation and Benefits), Enterprise Learning and Recruiting. She joined Fifth Third in 2004 and served in various Human Capital positions prior to her promotion to chief human resources officer.

“I am pleased to announce Teresa’s expansion of responsibilities,” said President Greg D. Carmichael, who is slated to become CEO on Nov. 1. “She has demonstrated her ability to lead positive change on numerous key initiatives and I am confident that she will provide outstanding direction to her expanded team.”

Tanner began her career with McDonald’s Corporation and has a vast background in education, human resources and operations management. She attended Pensacola Christian College and received her MBA from Xavier University.

Tanner has a long history of community involvement and impact. Her current commitments include serving as vice-chair of the Ronald McDonald House Charities and vice-chair of the ArtsWave Board of Trustees. She also serves on the Board of the FreeStore Foodbank and is active with the Women’s Leadership Council of the United Way.

Byna Elliott is Senior Vice President and Director of Community Economic Development for Fifth Third Bancorp

Byna Elliott is the newly appointed senior vice president and director of community economic development for Fifth Third Bancorp in Cincinnati. She manages the banks Community Reinvestment Act efforts, which includes, charitable giving, economic development for underserved communities, and lending in urban and rural markets. In her new position, she will be supervising the bank’s landmark $30 billion, 10-state, 5-year community development plan that the bank, along with partner National Community Reinvestment Coalition, announced in February 2016 and signed in November 2016.

Byna Elliott is the newly appointed senior vice president and director of community economic development for Fifth Third Bancorp in Cincinnati. She manages the banks Community Reinvestment Act efforts, which includes, charitable giving, economic development for underserved communities, and lending in urban and rural markets. In her new position, she will be supervising the bank’s landmark $30 billion, 10-state, 5-year community development plan that the bank, along with partner National Community Reinvestment Coalition, announced in February 2016 and signed in November 2016.

Fifth Third and NCRC have been working with more than 200 organizations in six cities, including Cincinnati, in shaping Fifth Third’s long term strategy for the program.

“My responsibility is to make sure that every dime of those funds is applied to improving communities where it is being invested, and to ensuring that businesses and residents in those communities have greater access to financial services,’’ Elliott said. “The proof of our success will be in the increase in home ownership, especially in the growth in first-time homebuyers, and in the success of small businesses in those communities.’’

‘This is a historical commitment being made by a large bank, with a 5-year commitment from the top down’’ she said. “It reflects well on Fifth Third Bank.’’ Elliott is a community reinvestment professional with over 20 years’ experience, including five years’ experience in administering all aspects of consumer compliance programs and Community Reinvestment Act initiatives.

A graduate of Eastern Michigan University in the late 1980s, Elliott, who has a degree in accounting and finance, immediately became a bank regulator during the banking crisis, overseeing financial institutions.

She started her career in her hometown of Detroit, Michigan, at the Office of the Comptroller of the Currency in 1993 and moved into the financial services industry in 1998. She most recently held the position of Senior Vice President, Regional Community and Economic Development Director for North Markets, which includes Eastern Michigan, Western Michigan and Chicago.

Elliott said she is very passionate in working to provide quality housing for families and closing the educational gap for youth. Her volunteer involvement in Habitat for Humanity in Michigan was statewide.

In her new position, Elliott will be involved in five statewide community stakeholder organizations, as well as a community advisory forums. She will connect with residents through community engagement meetings and through other means to determine the opportunities the bank can provide and the success of the programs.

“The challenge is getting the word out about the opportunities this huge community improvement program offers,’’ says Elliott. “Community organizations are our true partners in helping organizations and individuals become qualified to participate in the programs.’’

While in Detroit, she was involved in several community organizations, including serving as chair of Greater Works Foundation, and a board member of

St. Joseph Mercy Oakland, Habitat for Humanity, Wayne County Development Entity, Woodstock Institute (Chicago), and the Detroit Neighborhood Forum. She is also a member of Delta Sigma Theta Sorority and Links Inc.

Elliott is married to Anthony Elliott, who is a teacher and football coach. They have two children, Aaron, 13, and Imani, 17. She continues to be an avid reader, she said

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. The Company has $142 billion in assets and operates 1,299 full-service Banking Centers, including 101 Bank Mart® locations, most open seven days a week, inside select grocery stores and 2,630 ATMs in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Pennsylvania, Missouri, Georgia and North Carolina. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending, and Investment Advisors. Fifth Third also has a controlling interest in Vantiv Holding, LLC. Fifth Third is among the largest money managers in the Midwest and, as of June 30, 2015, had $304 billion in assets under care, of which it managed $27 billion for individuals, corporations and not-for-profit organizations. Fifth Third Bank was established in 1858. Member FDIC.